The Chancellor, it seems, has done it again.

For all the pre-emptive whispers of potential VAT cuts and unprecedented (in the UK, at least) voucher schemes, Rishi Sunak’s Summer Economic Update didn’t disappoint.

But if the coronavirus crisis has taught us anything, it’s that glorious headlines don’t always equate to glorious results – something hospitality’s ‘squeezed middle’ know all too well. So how will Sunak’s Plan for Jobs work in reality?

The temporary reduced VAT rate from 20% to 5% is fairly self-explanatory, and other than its omission of alcoholic drinks – which will see primarily wet-led operators experience less benefit than their food-led counterparts – the move has been welcomed by most.

From 15 July 2020 to 12 January 2021, the reduced rate will apply to supplies of food and non-alcoholic drinks from restaurants, pubs, bars, cafes and similar premises, along with supplies of accommodation and admission to attractions.

Alongside the cut, Sunak announced an all-new “Eat out to Help Out” scheme, a consumer incentive in the form of 50% dine-in discounts throughout August.

According to the government’s policy outline, the scheme will entitle every diner to a 50% discount of up to £10 per head on their meal at any participating restaurant, café, pub or “other eligible food service establishment.”

Discounts can be used unlimited times and will be valid Monday to Wednesday on any eat-in meal (including the price of non-alcoholic drinks).

The scheme will be entirely voluntary for operators, and those wishing to take part will be encouraged to register online, via a platform which will be made available on Monday (13 July).

From August, registered businesses will be required to apply the discount at point of payment, “and then can apply to be reimbursed by the Government on a weekly basis,” a Treasury spokesperson has told MCA. “They’ll then be reimbursed within five working days.”

But for those hospitality businesses who have temporarily shifted to a grab-and-go or takeaway-led operation in lockdown, they will have to re-introduce dine-in to see any benefit.

“Any establishment that sells food for immediate consumption on the premises and provides its own seating or shared seating with another establishment for eat-in meals will be eligible,” the spokesperson explained.

“Consumers looking to eat-in would get the discount, those opting for takeaway wouldn’t.”

So, although the Treasury has promised further detail in the coming days, it seems fair to assume that wet-led pubs won’t be the only operators to draw the short straw in Sunak’s support package. Food-to-go brands, and potentially those unable to offer dine-in due to new distancing rules, are also likely to miss out.

Despite this, with HIM/MCA Insight’s latest Recovery Report revealing that three in five consumers would feel worried going to hospitality spaces over and above supermarkets, convenience stores or offices, it is important to recognise the clear shift in government messaging that Sunak’s plan represents.

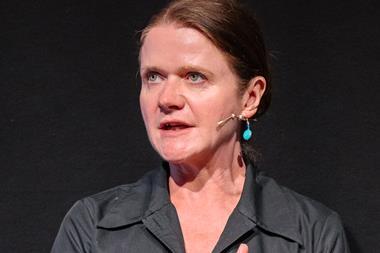

Commenting on the announcement, UK Hospitality CEO Kate Nicholls highlighted the value in this move to encourage the public back to hospitality spaces.

“Customer confidence is key to our sector’s revival and our ability to help Britain’s economic recovery,” she said. “Applying every precaution to provide safe venues will count for nothing if customers are not coming through our doors.”

“This significant VAT cut, heightened ability to retain staff and incentives for consumers to eat out together amount to a huge bonus. We hope that the UK public rightly sees it as sign that we are ready to welcome them back safely. The future of many businesses and jobs depends on it.”

“This doesn’t mean we are out of the woods, and there are still significant challenges ahead. Rent bills have piled up over the past few months even though venues were closed, and businesses are now facing huge rent debts with prospects for the future still in the balance. We are going to need Government support on this before too long.”

This cautiously positive response, combined with the message that there is still more to be done, was largely shared by figures across the industry.

Emma McClarkin, chief executive of the BBPA said: “These initiatives, which we have been calling for, will be beneficial for pubs that serve food and offer accommodation, and will also help compensate for an expected long period of reduced sales and revenue for pubs.

“The pub and brewing sector has huge potential to create thousands of new jobs and employ more people, but to do this it needs to be thriving, not just surviving. This will require more support in the medium term directed at all pubs and brewers so they can help lead with the economic recovery.”

Jonathan Downey, founder of Hospitality Union said: “Of course, any VAT reduction is a welcome measure and will help - if you’re open (over half of us aren’t) and trading well (nobody is) – but the ‘stimulus’ seems nothing like that to me. I was hopeful of much more than he announced and very surprised at the enormous level of fiscal support to those businesses and jobs that don’t really need it.”

“Maybe I’m missing something but this feels like a windfall for some (that need it the least) and nowhere near enough for the rest of us (that need it the most).”

Nick Mackenzie, CEO of Greene King said: “The new eating-out discount will be a great encouragement for customers to support the nation’s pubs at this vital time. While the cut to VAT on food is great news for the hospitality sector, it’s disappointing that it doesn’t extend to beer, given the heavy tax burden on brewers.

“The hospitality industry is by no means out of the woods following three months of closure and this continued government support will help preserve businesses and jobs as we emerge out of this crisis.”

Chris Jowsey, CEO of Admiral Taverns said: “Whilst I welcome the support to the hospitality sector provided by the chancellor, I’m very disappointed that he chose to support only those large pubs where food is a major income stream. Many local, community pubs do little food or are wet led, but they have worked tirelessly to support their communities during lockdown. The chancellors measures do not help these pubs at all and could be seen to be dissuading consumers from visiting smaller, local pubs. We would urge the chancellor to level up and support all pubs, regardless of their size, location and retail offer.”

James Watt, co-founder at Brewdog said: “We welcome the Chancellor’s announcement today on the VAT reduction to 5% for hospitality. We are going to pass on every single penny to our amazing customers.”

Adam Mani, CEO and founder of Creams Café said: “We have been vocal in our support of a temporary VAT reduction in recent weeks so are delighted with the measures announced by the Chancellor today.”

“We look forward to hearing more about the Eat Out to Help Out initiative, which we plan to fully support, and hope this will give customers additional confidence to visit our restaurants.”

Thom Elliot, co-founder of Pizza Pilgrims said: I am a massive fan (of Rishi and of his plan to get every household in the country eating out). Innovative and fun thinking - just what the sector and the public in general are crying out for!”

Paul Ruddy, leisure analyst at Goodbody said: “This price cut, via a VAT reduction, will improve price competitiveness versus supermarkets and the eating out vouchers will influence consumers to venture out again, albeit this is in the quietest part of the week and for a short period. This should help to get people back to enjoying experiential eating out.

“A further small positive for the sector is that it should not need to be as promotional to stimulate demand. Health concerns are still likely to trump the impact of these measures, particularly for the grey pound, but they are helpful as the embattled sector tries to recover from the impact of the pandemic. The chancellor clearly noted that if employers stand by their employees the government will stand by them.”

Precis

ANALYSIS

Sunak’s sector support – help out or wash out?

The Chancellor, it seems, has done it again. For all the pre-emptive whispers of potential VAT cuts and unprecedented (in the UK, at least) voucher schemes, Rishi Sunak’s Summer Economic Update didn’t disappoint. But if the coronavirus crisis has taught us anything, it’s that glorious headlines don’t always equate to glorious results – something hospitality’s ‘squeezed middle’ know all too well. So how will Sunak’s Plan for Jobs work in reality?