The UK Eating Out Market is set to decline 50-60% in the full year to December 2020. Is your business prepared for the challenges ahead? With social distancing measures set to remain in place for the foreseeable future, operators and suppliers will need to be prepared for a ‘new normal’.

The Lumina Intelligence UK Eating Out Report 2020 gives a comprehensive overview of the market, including market sizing, competitor analysis and consumer metrics for FY 2019. The report also includes a dedicated coronavirus section to show its impact on the eating out market and the channels that consumers have turned to during lockdown. Furthermore, the report looks at future scenarios for the market, based on the timing of the phased reopening of hospitality outlets. A further update will be available in September with updated forecasts for FY 2020 and beyond.

HOW TO USE THE REPORT

- Quantify the size and growth of the eating out market to benchmark your own performance

- Fully understand the competitive landscape with our extensive review – what can you learn and apply?

- Align your channel strategy to the trends in the market – understand where best to invest your time, people and money

- How have consumers responded to coronavirus and not being able to eat out?

- Do trends in the market align to proposed areas of investment?

- What could recovery of the sector look like? What trends will be important in 2020?

- Get under the skin of the eating out consumer to better meet their current and future needs.

Executive summary

Market Analysis

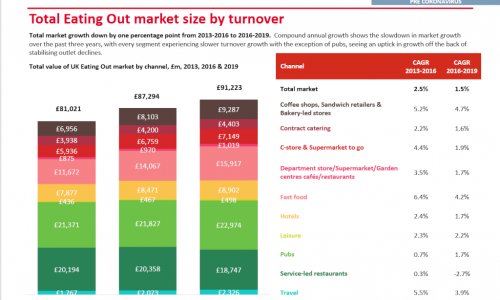

- What is the value of the market?

- How is the market evolving?

- What is forecasted for 2020?

- What is driving these changes? Competitive landscape

- An overview of the competitive landscape including physical expansion, financial performance and market positioning analysis.

Consumer Insight

- How are consumers’ eating out behaviours and perceptions changing?

- How often do specific consumer groups eat out?

- How are consumer demands evolving?

- Which channels do they use?

- How much do they spend? The impact of coronavirus

- A timeline of key events.

- Three scenarios for forecasting 2020 eating out market turnover decline.

- Analysis of how Eating Out brand operators have responded during coronavirus including the role of foodservice delivery.

- Assessment of the impact of the pandemic so far.

- Measurement of shifts in consumer behaviour so far and assessment of how consumers think their eating out habits will change post-lockdown.

Future Outlook

- What are the drivers for eating out?

- What are the inhibitors?

- What is the economic outlook?

- How could the dynamic meal equation look in the future? (balance of meals taken in home vs. OOH)

72,000 online surveys (6,000 per month) through Lumina Intelliegence’s Eating Out PanelTM.

- Extracts from Lumina Intelligence Operator Data Index and synthesis with wider market sizing databases.

- Insights from Lumina Intelligence’s Channel Pulse survey – 1,000 weekly consumer interviews

- Desk research: news articles and trade press, company websites and industry associations.