Based on thousands of data points, Lumina Intelligence’s Menu & Food Trends Report drills down on UK menus’ composition, pricing and engineering, as well as on current eating out behaviour and the trends to watch out for.

In 2019, underlying motivations revolve around health & wellness – from healthier food & drink choices, to sensible spending and sustainability.

The number of vegetarian and vegan dishes being flagged on menus is soaring. Consumers are more conscious about their health and the environment, choosing to eat less red meat and traditional heavier meals, and have more white meat and salad dishes.

In parallel, operators are being sensitive to the prevailing pressures on consumers’ disposable income. They are opting for subdued price rises and increased promotional activity.

How to use the report?

- Identify emerging menu & food trends set to grow in the future

- Compare your strategy with the rest of the market

- Align your food and drink offering to current and emerging consumer preferences

- Optimise your pricing strategy

- Augment the appeal of your menu via skilful menu phrasing and dish labelling

- Get inspiration from successful operators

- Gather quantitative evidence of emerging trends to support NPD

Menu Composition

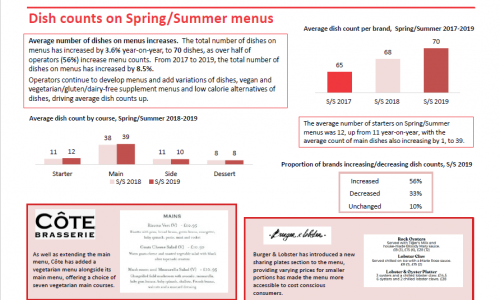

- New dishes flagged on menus Evolution of product counts

- Mains protein share and protein dish types by channel Labelling of dietary requirements incl. vegetarian & vegan

Menu Pricing

- Menu price movements by channel and course

- Top price rises on same-line dishes by channel, operator and course

Key Trends

- An overview of 8 leading megatrends Menu insights for each trend How operators are adapting to these megatrends. The implications of these trends on the market

- The outlook for these trends in 2019 and beyond

Menu Engineering

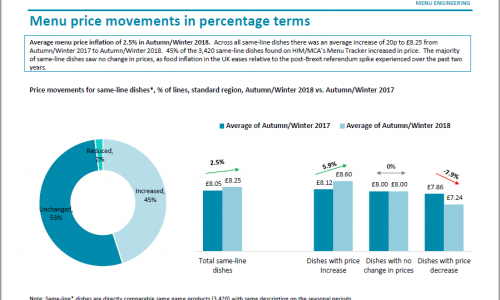

- Price movements for same-line dishes Average price increases by brand

- Consumer perceptions of price changes vs value

- Psychological pricing (£#.#9, £#.#5, £#.#0)

- Price point patterns and differences London vs regions

- Psychological phrasing/menu descriptors and impact on pricing

Consumer Insight

- Insight trends by dishes, cuisines, age, and channel

- Up to date consumer data to support the key trends affecting the market

Menu Trends

- Cuisine hotspots and food & drink trends

- Macro-factors affecting trends

- New product development on menus displaying operator responses to key trends

Detailed Spring/Summer 2019 menu and pricing analysis of 48 brands, using MCA’s proprietary Menu Tracker tool. Data collected in March & April 2018.

- Detailed analysis of psychological pricing and same-line dish pricing changes of 145 brands, using MCA’s Menu Tracker tool. Autumn/Winter 2018 and 2017 data used.

- 72,000 online surveys (6,000 per month) through MCA’s UK Eating Out Panel™.